Mexico: AMLO Preferential Law Initiative

Over the past two years, the Mexican federal government has been trying to enact their energy policy through a series of controversial publications. Nevertheless, to this date, none of these have caused any real changes on the system.

One of the most recent of these documents is the 2021-25 CFE Business Plan, which presents their flagship projects. There is also the 2020-34 PRODESEN, which describes the Ministry of Energy’s (SENER) long-term vision of the system and foreshadowed the publication of the Preferential Law Initiative signed by President López Obrador. This final document aims to change several dispositions of the 2014 Energy Reform, and finally transform AMLO’s policy priorities into a law!

First of all, what is a Preferential Law Initiative?

Unlike Regular Law Initiatives, Preferential Law Initiatives enforce shorter resolution terms, as these represent topics of high priority to the President1. This Law Initiative was submitted to the Chamber of Deputies this past January 29th, 2021 and their Energy Commission is in the process of reviewing this document. After a 30-day period, the Commission must bring it to the House for a vote. The Law Initiative will then be sent to the Senate for another 30-day review and vote; after which, if approved, it would be published on the Federal Gazette (DOF).

Once approved it is likely that amparos and constitutional controversies will be introduced, and the law deemed unconstitutional per judiciary precedents. However, it should be expected that some of the proposed changes will remain in effect.

What is the content of the Preferential Law Initiative?

➡️ Changes to the economic dispatch model,

➡️ Changes on the procedure to issue generation permits,

➡️ Changes to the criteria to accredit Clean Energy Certificates,

➡️ CFE Suministro Básico is no longer obligated to purchase energy via long term auctions,

➡️ Revocation of Self-supply permits.

⚡️ Changes to the economic dispatch model

Among the proposed changes, altering the methodology to dispatch power generation facilities within the SEN has the most severe repercussions as it opposes the main objective of the Energy Reform, i.e. to supply clean, low-cost electricity for the end-user based on market competitiveness.

As we explained in our latest blog entry, in a purely economic merit based system, the power plants with the lowest marginal, i.e. variable, costs are dispatched first. For instance, solar and wind generation are at the beginning of the merit curve, as these resources are virtually free of marginal cost since they do not need fuels to operate. Other clean energy technologies such as nuclear, geothermal, and run-of-river hydropower come next. These are followed by low-cost thermal baseload generation from CCGTs, cogeneration, and coal. Finally, more expensive and polluting fuels like diesel are used to cope with peak demand.

The point where supply and demand meet determines the price of electricity at that specific time (which is equal to the variable cost of the technology in question). This model has motivated a significant decrease of the electricity cost over the past few years, going from 83 USD/MWh in 2018, to 25 USD/MWh in 2020.

However, no system is perfect. In Mexico, some permit holders have dispatch priority (e.g. self-supply), while others are unable to respond to the grid operator instructions (e.g. nuclear) and are thus dispatched first. In addition, some power plants operate on a must-run basis (per their technical minimums).

Rather than improving the existing system, President López Obrador seeks to turn it on its head, using the following dispatch criteria:

- First, hydropower generation (where CFE owns most of these assets),

- Second, generation from CFE power plants (including PIEs2),

- Third, generation from wind and solar private assets,

- And finally, fossil-fueled generation from private players

Power generation facilities would be dispatched to cover the rising electricity demand, following this order and regardless of economic merit. This will reduce the share of clean energy in the system and increase the cost of generating power.

While we don’t yet have the specifics of how the dispatch model will operate (e.g. market manuals), Antuko expects it to function under very similar conditions to the Colombian wholesale market, where bilateral PPAs have physical delivery obligations and are dispatched first regardless economic merit. Any residual demand not covered by private PPAs, is left to market players which are dispatched based on their variable costs and paid the price of the “Bolsa de Energía” which is similar to the Mexican PML.

The main concern among industry stakeholders is: What is the size of this residual market? Will there be room for private participation?

To answer this, we may conduct a simple calculation to compare the maximum demand of the SEN, about 47 GW3, to the average available Capacity of CFE (Including PIEs) at 49 GW4.

It is clear form this simple exercise that CFE alone would have more than enough installed capacity to cope with the system demand even under stress conditions. However, this simple exercise only represents a first approach, and a more complex analysis must be done to size the impact of these changes, one that includes the system transmission restrictions, availability from specific CFE units, and the use of water by hydro power plants.

What about PMLs? As we mentioned before, if there is still room for private participation, the economic dispatch will prioritize renewable assets with variable costs close to 0 USD/MWh. However, it is important to note the importance of the transmission restrictions within the system. Even If CFE assets are dispatched first, it is very likely that in certain regions of the SEN the grid congestion will limit the transmission capacity, and hence, some renewable centrals might have to deliver this energy for reliability matters.

Our quantitative team is working hard to model this new dispatch of electricity. Reach out to us if you are interested in this outcome!

⚡️ Changes on the procedure to issue generation permits

The “Nahle Agreement” already tried to limit new permits but more than 70 amparos resulted in the suspension of this Policy, and ultimately, last week the Supreme Court invalidated its content as it “offers an unfair advantage toward CFE”.

However, the AMLO Preferential Law Initiative proposes that new permits will be subject to the SEN planning criteria defined by the Ministry of Energy. Based on the 2020-2034 PRODESEN, foresees the installation of 14 GW between 2020 and 2024 out of which 8 GW belong to CFE projects, while the remaining 6 GW must be met by private investment. However, under the current regulatory context, will developers take a chance on the Mexican market?

⚡️ Changes to the criteria to accredit Clean Energy Certificates

As we discussed several months ago in our blog entry, together with the long-term electricity auctions, Clean Energy Certificates (CEL)5 emerged as the market mechanism to achieve Mexico’s clean energy targets6. CELs accredit the production of a determined amount of electricity ( 1 MWh) through clean energy sources7.

1MWh = 1 CEL

The LIE Reform initiative brings back the 2019 proposal of crediting CELs not only to clean power plants built or reformed after 2014, with the idea to incentivize new clean capacity, but rather to all clean power generators. This implies a substantial change in the quantity of CEL offered in the market with major assets now being eligible and potentially flooding the market. With an oversupply of CELs in the market, its prices could drop between 50% and 60% in the next 15 years. Additionally, under these conditions, CFE Suministro Básico would comply with its CEL requirement toward 2033.

⚡️ CFE Suministro Básico is no longer obligated to purchase energy via long-term auctions

According to the LIE framework, CFE Suministro Básico is only able to purchase electricity via long-term electricity auctions (SLPs). To date, three SLPs have taken place, adjudicating 5,400 MW of solar PV, 2,400 MW of wind, 900 MW of combined cycles, 550 MW of turbo-gas, 68 MW of hydro, and 25 MW of geothermal energy, respectively.

However, the fourth long-term electricity auction was suspended by the AMLO administration to re-evaluate its scope. On December 11th, 2019, CENACE issued another agreement communicating that subsequent editions of the SLP were cancelled until further notice.

Now, President López Obrador aims to change this disposition. The main objective of the SLPs was to help the utility optimize its generation costs, while promoting investments in renewable capacity. Under this new context, CFE would be able to add new generation to its legacy contract, by-passing the market framework and, thus, reducing the size of the residual market.

⚡️ Revocation of Self-supply permits

Last, but not least, this Preferential Law Initiative proposes to revoke every self-supply permits8 in the market. In previous occasions, President López Obrador has mentioned these projects are under a “special regime” that poses an economic burden for CFE. In fact, these projects hold several advantages VS LIE PPAs, particularly:

- Energy banks: Energy generated in hourly period does not need to be directly matched by consumption but can be “virtually accumulated” by CFE over a 12-month period and “delivered” to users whenever they consume.

- Self-supplied Capacity: Capacity charges by CFE to the consumers may be offset by the Capacity recognition of their generation partner.

- No nodal differences: The energy injections and withdrawals do not entail the risks of differences in spot market prices (PML) of different locations.

- Economic Dispatch: Generators with self-supply PPAs are considered non-dispatchable sources and thus inject their energy to the grid before other projects regardless of economic merit.

On February 13th, 2020, the CRE proposed a Ruling to modify the Self-supply regulatory framework, via the National Commission for Regulatory Improvement (CONAMER). This initiative seeks to modify the terms to request a modification or permit transfer of legacy power generation facilities, hence restricting the addition of new load points or even the extension of existing ones.

Then, on July 10th, 2020, CFE Intermediación de Contratos Legados, a CFE subsidiary in charge of managing the Self-Supply contracts, published in the DOF the new postage stamp fees for legacy project generators. This update was approved by CRE on May 28th, 2020, being the following:

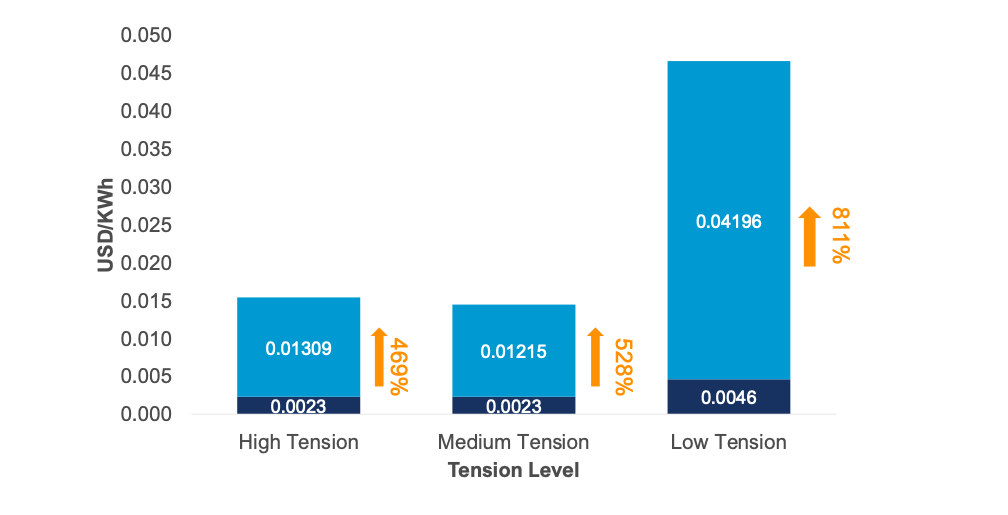

This update generated a lot of controversy among industry participants as the high and medium tension fees experienced an increase from 0.0023 USD/kWh to 0.01309 USD/kWh and 0.01215 USD/kWh (469% and 528%, respectively), while the low tension fee increased from 0.0046 USD/kWh to 0.04196 USD/kWh (811%). Immediately after its publication, many companies started to take legal action, which derived to the issuance of several provisional suspensions against this fee change.

Based on the previous events, it is clear the AMLO administration holds the participation of legacy projects at the top of his agenda, and many changes are expected to come. Particularly, in Antuko, we foresee these permits will be revoked and eventually operate under the following scenarios:

- PIE framework: While the Law Initiative is not clear on this matter, it is expected that legacy self-supply permit holders might try to renegotiate their contracts with CFE, and participate under the PIE figure. This is specially true of shared-property units.

- LIE framework: With the revocation of permits, in order to maintain their assests operational and limit losses, permit holders might migrate to the LIE framework, putting an end to the LSPEE heritage.

On the consumer side, load centers that lose their Self-Supply PPAs will return to CFE Suministro Básico. President López Obrador promised regulated fees will not increase in real terms for the Basic Supply Fee users. While residential fees might not experience any changes, C&I users will certainly be affected (GDMTH and GDMTO fees, for example). This will result in more expensive electricity, and thus more expensive goods and services, hence, impacting the economy of the end-users. Considering this situation where C&I regulated rates are high and PMLs are low, there will be an important incentive for users to migrate to the Qualified User figure!

In the aftermath of these events, what can we expect in the following days?

As mentioned before, this Preferential Law Initiative is now under revision by the Energy Commission (this process can take up to 30 business days). After this, the verdict is passed to the House of Representatives for voting purposes. If approved, the Preferential Law Initiative passes to the Congress, where it has to be evaluated and voted as well (once again, this process can take up to 30 business days). If Senators do not issue any observations/comments on regard of its content, the President is entitled to enact it.

What happens If the Congress holds observations against the Preferential Law Initiative?

These points must be a matter of discussion among the House of Representatives and the Preferential Law Initiative can suffer modifications. Once again, it has to be passed to the Congress until there are no further comments/observations.

If the Preferential Law Initiative is enacted, is there any chance to invalidate it?

In case the Congress approves the Preferential Law Initiative and is finally enacted by the President, industry stakeholders could still present an unconstitutional action against it. Through this measure, the Supreme Court has the responsibility of studying its scope. However, this unconstitutional action can only be submitted by determined legitimate entities9.

In the meantime, private industry players can amparos to suspend the impacts of these kinds of initiatives. However, an injunction issued under an amparo proceeding provides for personal and individual effects that exclusively benefit the amparo petitioner. Nevertheless, in exceptional cases the injunction may provide for general effects (erga omnes) when the petitioner claims a “legitimate interest”, e.g. environmental grievance such as Greenpeace recently presented against both the CENACE Ruling and the SENER Policy.

On the other hand, the possibility of submitting these claims to international arbitrage remains a valid alternative. However, these trials could take years, resulting in the loss of appetite from private investors.

Without doubts, the political and economic convergence in the country has brought much uncertainty to the energy sector. Even If this Preferential Law Initiative is rejected by the Congress, Mexico still anticipates an important election period in July 2021, where representatives for local and federal congresses will be elected in half of the country. If MORENA representatives are elected and back President López Obrador, this party may consolidate a major political force sufficient to constitutionally reverse the Energy Reform.

There is much at stake. Mexico’s energy policy priorities clearly contravene several UMSCA dispositions, and with Biden presidency, many efforts are expected to push the energy transition discussion beyond borders. On the other hand, the pandemic gave some slack to CFE in terms of electricity demand growth, but as soon as it recovers, the utility would not be able to cope alone without new investments. On the bright side, this Preferential Law initiative is generating much discussion, that hopefully will result in finding a common ground between public and private players.

In the meantime, our team is conducting a quantitative analysis to determine the potential impacts of this initiative on the dispatch model. Curious about the main findings? Contact us here: mexico@antuko.com

[1] In fact, the President has the faculty to present two Preferential Law Initiatives per legislative period.

[2] Independent Power Producer (PIE, per its Acronym in Spanish), is a legal figure that derived from the 1992 Public Service Electricity Law (LSPEE) aiming to open the power generation segment to private participation via bilateral PPAs with CFE.

[3] Real withdrawal demand (CENACE). Occurred in June, 20th, 2019

[4] Data from PRODESEN 2020-2034, considering 44.8 GW of CFE capacity and 16.7 GW of PIEs and an unavailability of 20%

[5] CEL (per its acronym in Spanish)

[6] Mexico holds international commitments to reach 30% of its energy generation from clean energy sources by 2021, 35% by 2024, 40% by 2035 and 50% by 2050.

[7] In Mexico, clean energy sources consider: solar, wind, hydro, nuclear, bioenergy, and geothermal. Some CHP and thermal assets can accredit CEL based on a fuel-free energy production percentage.

[8] To date, these represent 11% of the installed capacity in the country

[9] For instance, the National Human Rights Commission (CNDH, per its Acronym in Spanish), State and municipal level representatives, etc.