The Puerto Peñasco solar project: The growing necessity for a better transmission network

In June of 2021, President Lopez Obrador asked Alfonso Durazo, the Governor of Sonora, to evaluate commissioning a solar project in the state. This would be the first renewable project of the AMLO presidency and would consist of a 1,000 MW plant in Puerto Peñasco, a city in northern Sonora. With that capacity, the project would be the largest solar PV project in Latin America and the eighth largest worldwide. Besides, the privileged location of the plant would make it extremely productive thanks to the high solar radiation in the area. The project could have a capacity factor, a measure of how much energy is produced by a power plant as compared to its maximum capacity, as high as 36%, one of the highest in the world for solar PV. Nevertheless, its location would also represent a significant constraint, since the lack of transmission infrastructure in Sonora prevents much of the energy generated from being exported. This situation interferes with the future development of renewables in all of Mexico, as the generating capacity grew rapidly since the Energy Reform of 2014, but the development of the transmission network was left behind. As a result, renewable power plants, particularly in Sonora, face complex entry barriers.

First and foremost, Sonora already has 1,250 MW of installed solar capacity, more than 17% of the country’s solar capacity. However, Sonora also has very limited transmission infrastructure, meaning that it is unable to export most of the energy produced. The transmission lines that connect Hermosillo, the state capital, with the rest of the system worked above their operating limits for 2,625 hours in 2020 (30% of the year), mostly during solar hours, and the situation continues to the publication of this report1. Sonora’s limited local demand and the surplus in production led to the lowest Local Marginal Prices (PMLs) in Mexico. To put this into perspective, PMLs in the Nacozari node, used by Antuko as a reference for the Northwest region, averaged USD 29.4/MWh year-to-date 2021, whereas the high-consuming Central region (Victoria node) has an average year-to-date PML of USD 42.8/MWh. By contrast, the highest PMLs occur in the Peninsular region, where prices averaged USD 47.1/MWh.

With prices already well below the national average, the additional capacity of the project, combined with a lack of reinforcements to transmission lines to evacuate this excess energy, will increase congestion and prices will drop even further. This phenomenon is commonly known as “cannibalization” and would result in lower incomes and higher curtailment for solar power plants in the region, including Puerto Peñasco itself. It is, therefore, imperative to complement the project with the necessary infrastructure that will allow energy exports. The subject matter is then, where to export this large amount of solar energy? Sonora has a relatively small population and low electricity consumption and is far away from any major consumption area.

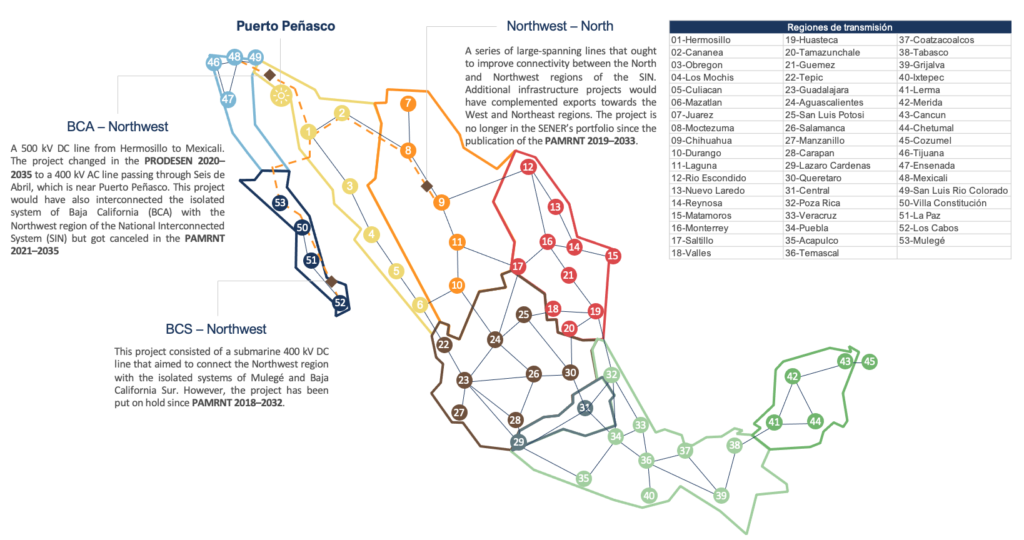

In the past, CENACE, the system operator, identified the same problem regarding the growing penetration of solar PV in the region that resulted from the Energy Reform. The Ministry of Energy (SENER) then instructed three major transmission projects that would alleviate congestion and continue to foster the development of renewables in the Northwest region:

Although it is currently canceled, Governor Durazo informed in a public address that the solar project will be accompanied by the BCA – Northwest line and that it would be operational by the end of 20232. However, the date seems too ambitious, not to mention that it is unclear if the USD 1.7 B budget takes into consideration the transmission line, which alone would cost an estimated USD 1.1 B3. If so, the budget for the plant itself would be USD 585 M, which is not enough since the average build cost for a utility-scale solar PV is USD 936 K per MW4. Therefore, it is most likely that another substantial investment will be needed for the development of the required infrastructure for the viability of the power plant.

There are additional risks regarding adding more capacity without strengthening the local network. The constant saturation at which local networks are already working imposes a threat to reliability and energy security. Furthermore, the project faces a severe risk of curtailment, meaning that the power plant will not be able to inject all the energy it generates into the system. If curtailment occurs, solar PV, when available, would be the only energy source in the dispatch curve, making local PMLs virtually zero and inhibiting profits for the power plant in a merchant scheme. The only alternative source of income for the power plant would be through a Power Purchase Agreement (PPA). Nevertheless, the Electricity Industry Law requires that the CFE Basic Service Provider (CFE SSB), potentially the biggest user for the power plant, acquires all energy through electricity auctions, which are currently canceled, or through Legacy Projects. As such, Puerto Peñasco would not be able to commercialize energy to CFE SSB.

RESULTS

These potential risks are evident while modeling the plant with Plexos, the industry-leading power system modeling tool. Antuko designed two scenarios:

- BCA interconnection: Puerto Peñasco and the BCA – Northwest 400 kV line begin operations in April 2025 (the official date for the transmission line in the PRODESEN 2020 – 2034

- No BCA interconnection: Puerto Peñasco enters into operation in April 2025 with no additional transmission development.

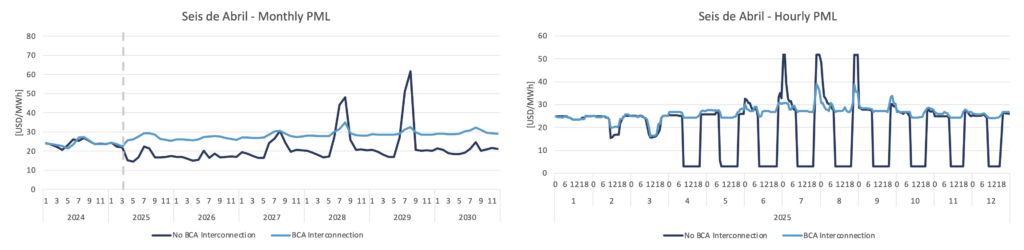

In the No BCA interconnection scenario, the added capacity saturates the network as soon as it enters the system, as can be seen in the figures below. The hourly resolution of projected PMLs demonstrates that excess solar generation congests the local network, displacing other technologies from the merit curve, and PMLs plummet close to zero. Meanwhile, the monthly resolution shows that the supply of electricity will exceed demand by a long margin from the commissioning of the power plant to the end of the horizon, despite the growing demand. By contrast, PMLs do not fall to the same extent in the BCA interconnection scenario. Indeed, the high installed solar capacity in the area causes PMLs to decrease during solar hours, if only by USD 2/MWh.

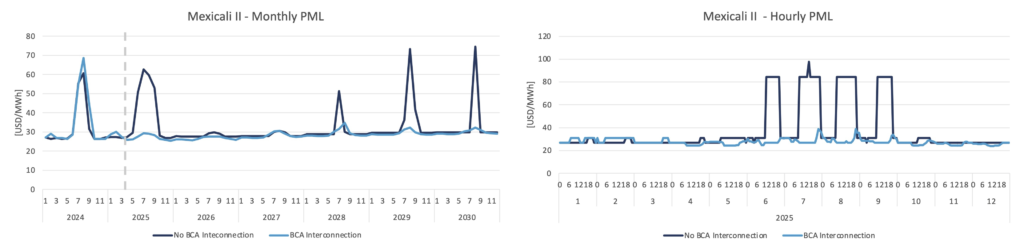

It is worth noting that peak PMLs are higher in the No BCA interconnection scenario, as can be seen in the monthly resolution during the summers of 2028 and 2029; and in June and August of the hourly resolution. The higher PMLs in the evenings occur as the only energy available to meet the high demand in summers comes from expensive thermal generators. On the other hand, the smoother profile exhibited by the BCA interconnection scenario comes because of what happens on the other side of the line. The Baja California system, despite having limited generating capacity, has around 1.7 GW of capacity from combined cycles, the most cost-efficient thermal generators. Besides, CFE plans to build two Combined Cycle power plants in Baja California, CC Rio Colorado and CC González Ortega5, that will provide the newly incorporated region of the SIN firm energy in the short to medium-term. In this way, the union between BCA and the SIN would strongly favor Sonora as it would provide an escape route to excess solar generation and deliver cheaper firm energy at times when renewable resources are not available.

Looking at the prices in Baja California, it is evident that the combination of the solar power plant with the transmission line will have a positive impact on the region, compared to not adding any reinforcements. Basically, the No BCA interconnection scenario reflects the current operation of the BCA system, where prices are stable in the months when the weather is moderate but, when the temperature rises in the summer, demand goes up and PMLs skyrocket as costly thermal power plants are deployed. Conversely, the BCA interconnection scenario depicts an improvement in the operation of the region as PMLs would be slightly lower during solar hours thanks to a cheaper and cleaner electricity supply. Additionally, summer peaks would be strongly mitigated as combined cycle power plants from Sonora would supply a demand that would otherwise be met by oil power plants.

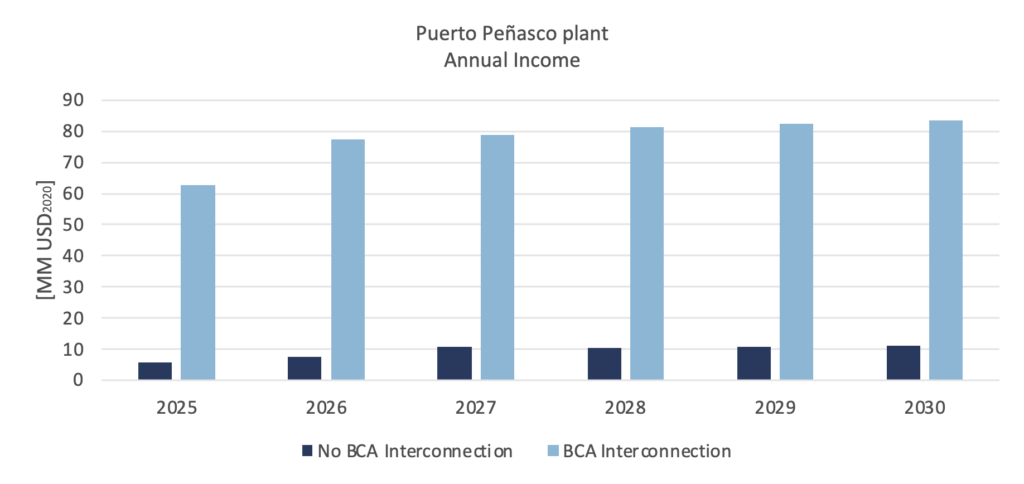

Regarding the project as such, it is fundamental to have a network reinforcement of the magnitude of the BCA line. To begin with, the limited transmission in the No BCA interconnection scenario will result in more than 40% curtailment in the first two years of operation. Afterward, local reinforcements will improve the situation, but Puerto Peñasco would still not be able to dispatch more than 75% of its total capacity. In this way, the plant would generate substantially less revenue as it would dispatch much less and at a fraction of the price due to curtailment. The chart below compares the annual incomes of the power plant from its start to 2030 in a merchant scheme, in it, one can see that the revenues are remarkably higher in the BCA Interconnection scenario.

FINAL THOUGHT

A lot of progress has been made in enlarging the generating capacity since the Energy Reform. The share of renewables and more efficient thermal technologies in the energy mix grew rapidly ever since, and 2019 was a record-breaking year as more than 12 GW of new generation capacity entered the system. Transmission expansion also saw a significant rise that helped reduce the price gap between the regions of the SIN up until the change of administration in 2018. The network growth has fallen behind quickly since then, leaving regional peculiarities concerning the supply-demand balance. Furthermore, the lack of growth in transmission infrastructure is also making the expansion of renewables more complicated as regions rich in wind or solar resources are often far from high-consumption zones. It is already the case with Sonora, meaning that any large-scale project such as Puerto Peñasco will require further development in the grid to succeed.

[1] CENACE, «Plan de Ampliación y Modernización de la Red Nacional de Transmisión,» CENACE, Mexico City, 2021.

[2] G. Moreno, «Planta de energía solar llegaría a Sonora en 2023: Alfonso Durazo,» 19 July 2021. [Online]. Available: https://www.elsoldehermosillo.com.mx/local/planta-de-energia-solar-llegaria-a-sonora-en-2023-alfonso-durazo-6980891.html.

[3] J. M. Cullell, «El gesto del Gobierno mexicano hacia las renovables: el gran parque solar del desierto de Sonora,» 15 July 2021. [Online]. Available: https://elpais.com/mexico/2021-07-16/el-gesto-del-gobierno-mexicano-hacia-las-renovables-el-gran-parque-solar-del-desierto-de-sonora.html.

[4] NREL, «Annual Technology Baseline,» U.S. Department of Energy, 2021.

[5] CFE, «Plan de Negocios 2021 – 2025,» CFE, Mexico City, 2021.