AMLO Memorandum: Potential Changes to the Economic Dispatch Model

The AMLO administration has tried to introduce several regulatory changes with the objective of strengthening CFE. In the past months, industry participants have issued amparos against some of these regulatory modifications, such as the CENACE and SENER Rulings. While these efforts have been followed by indefinite injunctions, President López Obrador (AMLO) is now considering to escalate this conversation to the Senate and begin a Counter-Reform process.

On July 22nd, a memorandum addressed to industry regulators such as CRE and CNH was leaked. This document presents a series of instructions aimed to reinforce the productive state enterprises: PEMEX and CFE. Within the power sector, the most relevant points are the following:

- No real-term increase in the price of fuels (diesel and gasoline), as well as electricity

- Attain energy self-sufficiency

- Prioritize the most profitable option to either construct or modernize power stations to satisfy demand in the Yucatan Peninsula and South Baja California

- Boost hydropower generation

- PEMEX and CFE will revise contracts that were signed under previous administrations and will respect them in as much they are not considered fraudulent

- Subsidy suppression toward private players

- The SEN must be dispatched in the following order: First hydropower generation, on second place CFE Generation, on third place wind, solar, and other clean sources, and lastly private fossil-fueled units.

- CFE must draft and execute a plan for the use and sale of any excess natural gas they may have, this to avoid fines and penalties

- Stop granting concessions to private players in the medium and long-term

- Support and strengthen PEMEX and CFE

- Public-Private Associations are not discarded, so long as they do not affect the national interest

The seventh point caused much controversy for market analysts as its implementation would modify the economic dispatch model followed in the National Electrical System[1]. What is this economic dispatch model all about? This model, widely used on power markets across the world, consists on satisfying a system’s demand at the lowest possible cost. For this to take place, the Independent System Operator (ISO)[2] must execute the following actions to meet this requirement every hour at every node of the system:

Demand estimation: CENACE revises historical demand records to estimate the needed MWs to supply electricity to the system. (Under the current sanitary crisis, this task has been particularly difficult this year!)

Generation availability: CENACE receives offers from available generators and orders power plants by their marginal costs, dispatching those that represent the lowest cost to the system.

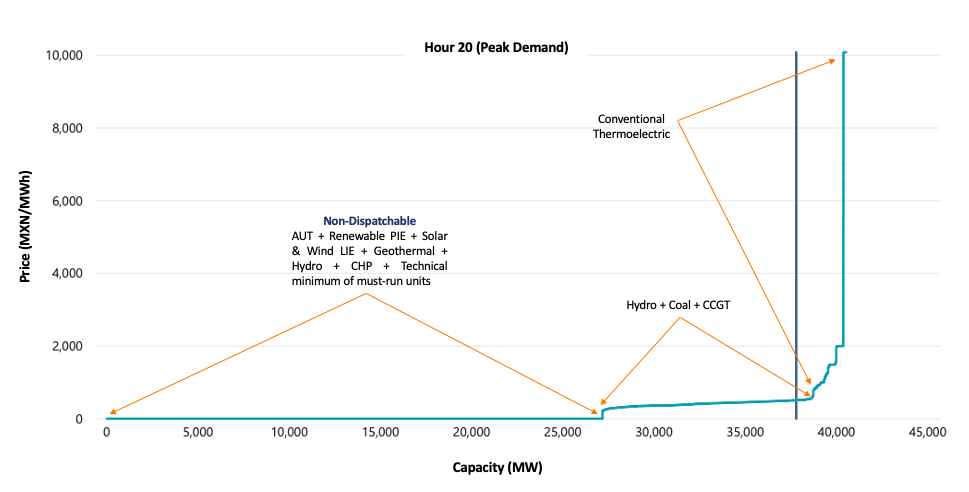

The following graph shows the demand/supply balance of the National Interconnected System (SIN)[3] this past November 26th in the SIN:

Graph A. Supply/Demand Balance at the SIN por the peak hour on November 26th, 2020 (Source: MIM [4])

While Y axis presents the variable costs (MXN/MWh) of available power plants present in the SIN, the X axis shows demand at the peak hour of the system.

In a purely economic merit based system, the power plants with the lowest marginal or variable cost[5] are dispatched first. For instance, solar and wind generation are at the beginning of the merit curve, as these resources are virtually free of marginal cost since they do not need fuels to operate. Other clean energy technologies such as nuclear, geothermal, and hydropower come next. These are followed by low-cost thermal baseload generation from CCGTs and coal. Finally, more expensive and polluting fuels like diesel are used to cope with peak demand. The point where supply and demand meet, determines the price of electricity at that specific time (which is equal to the variable cost of the technology in question). For instance, on November 26th at 8:00 pm, the SIN needed around 38,000 MW to cope with peak demand, and the average price of electricity was of 600 MXN/MWh as the technology that fixed this price was a CCGT.

However, CENACE takes into account other parameters into the economic dispatch algorithm to comply with the system’s needs. First, it classifies power plants as Dispatchable and Non-Dispatchable, based on their ability to increase or reduce their generation in an hourly basis. For instance, solar and wind assets (which are Non-Dispatchable, as their generation levels depend on the resource availability), are dispatched first. This priority, besides being assigned due to the zero marginal cost these technologies represent to the system, also exists to take advantage of their availability and comply with our clean energy targets[6]. On the other hand, thermal technologies that run with fuels, are considered to be Dispatchable.

Under this Dispatchable and Non-dispatchable regime, legacy contracts (particularly under the self-supply scheme[7]), operate under a very special case. These units are dispatched even if their marginal cost falls outside the merit order, as these assets must comply with their contractual commitments. In addition, other power centrals that provide reliability to the system in the form of ancillary services also have priority over economic dispatch. These must-run units operate at their technical minimum which is considered to have a zero marginal cost. If these must-run units are needed beyond their technical minimum, this additional capacity participates in the economic dispatch algorithm with their (usually very high) marginal cost.

Despite some important shortcomings, this optimization mechanism ensures the least expensive resources are used to meet the system requirements. AMLO, however, proposes to change the dispatch model by prioritizing CFE generation over economic efficiency. By following this criterion, the merit order would look like this:

- First, hydropower generation (where CFE owns most of these assets),

- Second, generation from CFE power plants (regardless of economic merit),

- Third, generation from wind and solar assets,

- And finally, fossil-fueled generation from private players (such as CCGTs)

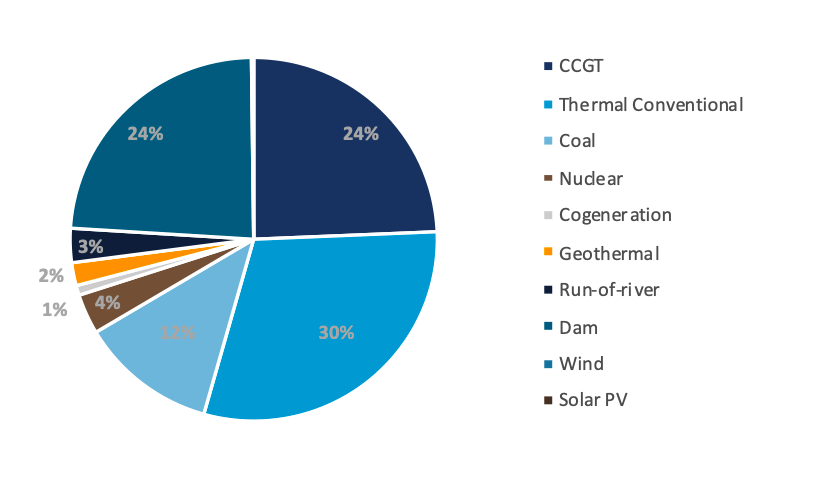

To date, the SEN holds an installed capacity of 85 GW, whereas CFE owns mostly half of this amount (41 GW). More than 50% of CFE capacity comes from thermal technologies, followed by a strong participation on the hydropower segment (mainly dams).

Graph B. CFE Installed Capacity per Technology (Source: Antuko)

These proposed changes have left the industry in uncertainty, as it is unclear how this new dispatch model would affect not only the prices of the system but also the shares of generation per technology and the capacity of Mexico to uphold Clean Energy Targets. Unfortunately, there is not yet enough information available to answer these questions. However, Antuko realized a theoretical exercise to assess whether private units would be dispatched in a new dispatch model where CFE power plants are dispatched first. This exercise considers a time horizon of 15 years to better grasp the implication of this change in the market.

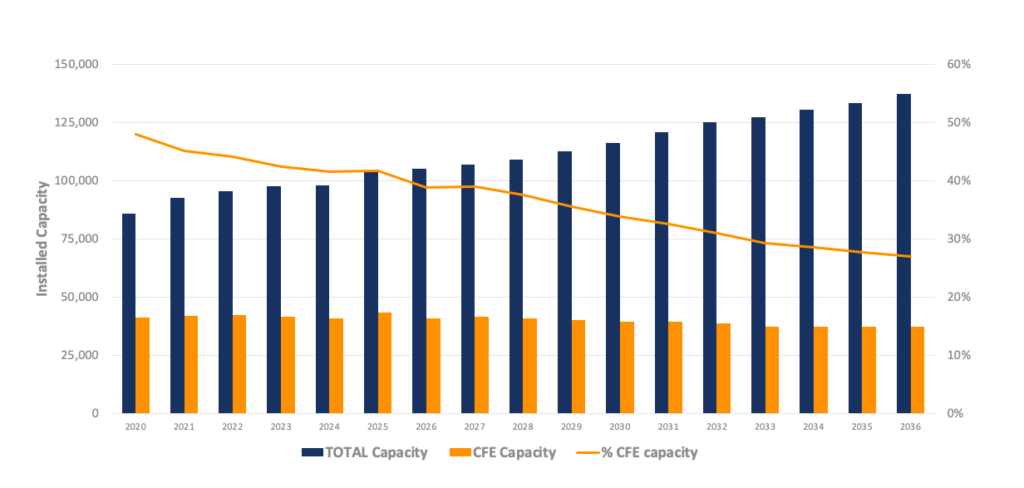

In past years, the evolution of CFE installed capacity has dropped significantly, and this trend is set to continue. To date, the SEN holds and installed capacity of ~85GW of which assets the state utility owns 48%. Based on our Works Plan, Antuko foresees this amount will experience growth in absolute terms until 2025. Afterwards, this share will decline due to decommissioning of obsolete, expensive plants that run with diesel and coal.

However, with an increasing energy demand, the current investment efforts would not be enough to cope with its growth. The following graph shows this behavior in a 15-year horizon:

Graph C. Evolution of CFE Installed Capacity – Antuko Works Plan (Source: Antuko)

Over the long-term, CFE installed capacity will decline to about 28% of all assets, and this without counting Distributed Generation! However, CFE will continue to own relevant thermal plants with high marginal costs. Under this context, it is understandable why the current federal administration is trying to strengthen CFE! Their generation park is old, with assets that have been in operation for more that 40 years. While the market share of CFE is dominant, most of its plants are no longer able to operate optimally and as a result, have high unavailability rates. Antuko also modeled the evolution of demand, and considered the unavailability rate for each CFE plant for this calculation. On average, this value is of 21% along our study horizon.

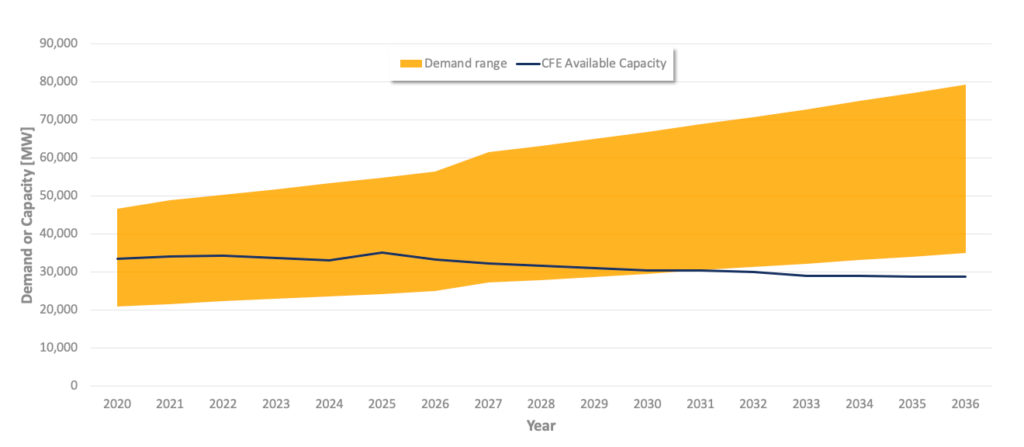

Graph D. CFE Available Capacity and Demand Range – Antuko Works Plan (Source: Antuko)

Graph D shows how CFE annual average available capacity covers an important demand range on the first years of the study. However, starting 2031 this available capacity will not be sufficient to cover even the minimum demand of the system. Thus, private participation would be necessary to supply high demand periods of the early years and at all times in later years. In addition, one must consider that this simple exercise does not include the limits of the transmission grid.

What about the short-term repercussions? It is important to evaluate the first years of the study, when CFE mostly covers the system demand and there would be high probability of curtailment for private renewable sources.

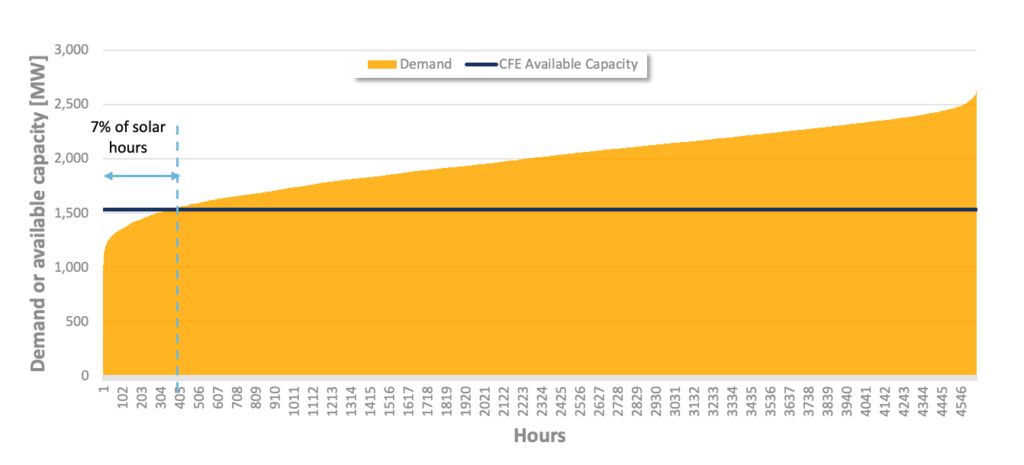

Graph E. Distribution of Demand during Solar Hours in 2022 (Source: Antuko)

The previous graph presents the distribution of demand during solar hours in 2022, and then is compared to CFE available capacity during that same year. CFE holds the sufficient capacity to cover demand during 15% of solar hours. However, the rest of the time, the participation of private power plants (up to 12 GW) would be needed to supply demand. This amount represents and almost total dispatch of solar and wind capacity within the system. Again, without considering the limits of the transmission system, which are posed to increase the dispatch of renewable sources in some regions but might limit them in others.

While this preliminary analysis shows that CFE plants could cover an important part of the SIN demand during solar hours, private generation would be needed most of the time. The risk of experiencing curtailment is higher during the early years of the study but should be limited to a range between 10-20% per year.

After this review, it is unlikely that changes in dispatch would be applied exactly as the AMLO Memo intends. It is also unlikely that NO changes would occur. One should instead expect a middle-ground solution in which currently prioritized sources, such as Self Supply (AUT), are brought into the competitive marginal cost system. This would definitely hurt AUT projects, but might also strengthen the economic dispatch model as a whole by increasing the volume of energy that depends on economic merit for dispatch.

Legislators could also prioritize CFE projects in as much as they provide reliability to the system, which means some older, expensive, and polluting CFE units would run even if outside of economic merit. However, both international agreements and the Mexican constitution mandate that the SEN increase its share of Clean Energy, which strengthens the role of renewables. Much of this compromise will depend on the results of the 2021 mid-term election. We will keep our eyes open!

[1] The National Electric System (SEN, per its acronym in Spanish) holds more than 4,500 nodes distributed along the country.

[2] CENACE

[3] The SIN is part of the SEN, however this system does not include BCA and BCS.

[4] Independent System Monitor, MIM, per its acronym in Spanish

[5] Also known as marginal cost, it represents the cost of supplying one additional MWh of electricity into the system. This calculation only considers OPEX, hence its value is strongly influenced by fuel prices.

[6] Within the Energy Transition Law (LIE, per its acronym in Spanish), Mexico committed to achieve 35% of its power generation from clean energy sources by 2024, 40% by 2035, and 50% toward 2050.

[7] Autoabastos (AUT)