Snowstorm in the US, Power Outage in Mexico

Power infrastructure is not prepared to face the climate emergency threat. Just last week, the Uri winter storm left close to 4.3 million Texans in complete darkness! Repercussions were felt beyond US borders, particularly in Mexico, where a shortage of natural gas caused rolling blackouts throughout 12 states, with prices spiking up to 1,870 USD/MWh!1

Let’s state the facts:

On February 14th, Uri winter storm started out in the Pacific Northwest and quickly moved into the Southern United States causing temperatures of -20ºC. Natural gas infrastructure cannot operate under these freezing conditions. Due to the record-setting demand for heat, OGT2 gas prices reached 600 USD/MMBtu. In addition, once power plants went offline, these were not prepared to restart in below-freezing conditions3.

According to the Electric Reliability Council of Texas (ERCOT), demand peaked at 69 GW on Sunday 14th, surpassing its planned worst-case scenario. Immediately after, the ISO conducted rolling blackouts to avoid major grid damage.

The picture was not very different in Mexico. On February 13th, CENACE declared an operational state of alert within the SIN given the rise of natural gas prices coming from the US, and potential short-term unavailability. One day after the massive storm hit Southern US, a power outage caused the outage of 6,950 MW, affecting close to 4.7 million users in the states of Nuevo León, Chihuahua, Tamaulipas, Coahuila, and Durango.

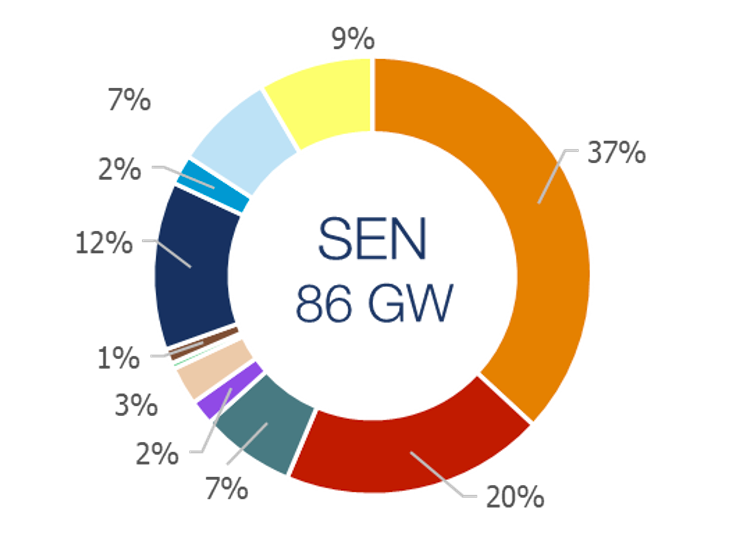

Under this complex geopolitical scenario, Texas Governor Greg Abbott banned state-wide gas exports until February 21st. Let’s remember natural gas makes up for 36% of Mexico’s energy matrix4, and that 60% of this amount is imported from the US (particularly, from the Houston Ship Channel and Waha hubs). Immediately after the export ban, CENACE issued a critical alert within the SISTRANGAS.

Finally, on February 16th, following the steps of the Texan grid operator, CENACE executed a series of rolling blackouts on 12 states of the country. This is not the first time an event of such nature jeopardizes the electrical supply in Mexico. On December 28th, 2020, a massive power outage hit the SIN, leaving close to 10.3 million users without electricity supply for two hours.

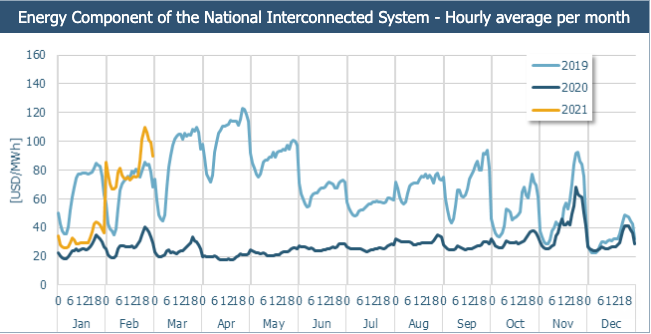

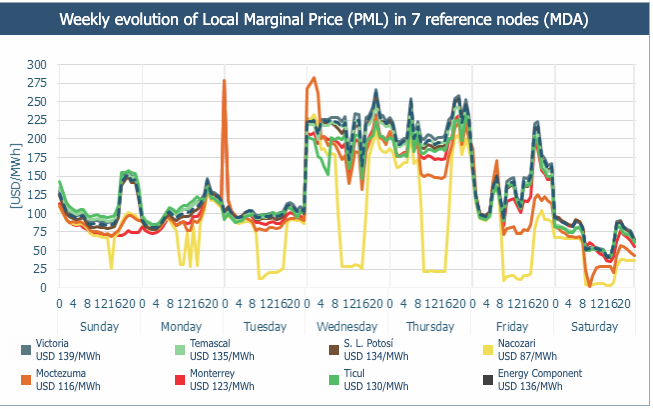

But how these contingencies look like in terms of pricing?

Due to the shortage of gas coming from the US, the ISO was forced to use alternative, more polluting fuels like diesel and fueloil5. Prices were particularly high from Wednesday, when power was restored to most of those affected by the shortage, to Friday, when Texas removed the ban on gas exports.

In fact, CFE Energía conducted several fast-track auctions to purchase four LNG vessels and face this contingency. To date, Mexico holds three LNG storage terminals, with a joint capacity of 2,290 MMpcd. According to CENAGAS, this amount only covers the country’s demand for 1.5 days! European standars, for example, request at least 90 days of storage to address seasonal shortages or emergencies. This event clearly showcased the vulnerability of the SEN in terms of energy security, as well as the risks of depending on a single power generation source and a single supplier.

What about renewables?

While in some regions of the SIN PMLs spiked to historical maximums since 2018, the Northwest control region, which should have been hit the hardest, continued to experience the lowest PMLs of the system. Although most of the North and Northeast PMLs were very high as compared to their historical values, the Northwest region was clearly decoupled and still had values close to zero as excess solar generation continued to drive down PMLs during the daytime.

Hence, while some thermal Generators struggled to receive any incomes during this week, renewable were rewarded by their availability on this complicated situation by receiving high incomes!

What are the learned lessons, then?

The interruption of electrical supply is a matter of concern. In Texas alone, so far, the dead toll amounts to 80 people, while in Mexico this figure is around 12. Despite the economic loss, we should rethink our vulnerability toward extreme weather events, and how to mitigate its impact.

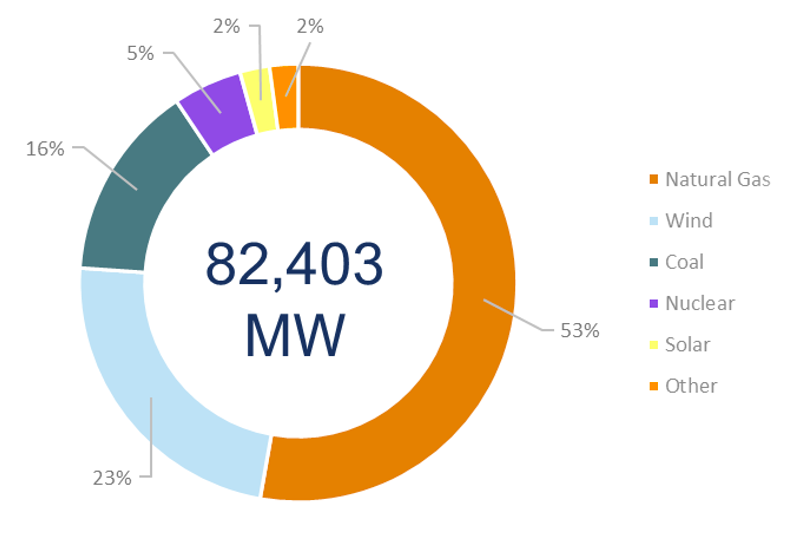

While Mexico and Texas are different in terms of territorial extension, ERCOT’s installed capacity is almost the same as the entire SEN, yet it only serves 26 million customers:

However, both systems use natural gas as their primary energy source.

In addition to this, both ERCOT and the SEN are “electrically independent”, meaning these have a few interconnections to other neighboring power markets6.

The main difference relies on energy independence. While ERCOT holds access to the cheapest natural gas reserves in the world, Mexico imports 60% of its consumption from these hubs. Even under such advantageous conditions, the Texan system was 4 minutes and 37 seconds away from a blackout that could have lasted months!

As we have seen in the last weeks, each system will prioritize its own needs, and such dependency must end. On the other hand, while both governments blamed renewables in the aftermath of these power outages, the participation of solar generation helped to cope with demand during the day.

In Mexico, this discussion is quite contradictory. While renewables could drive the system diversification, and at the same time decrease GHG emissions, the current energy policy insists on generating dirty electricity from thermal sources like fuel oil. Eventually, this issue will motivate further weather extreme events the current power infrastructure is not able to cope with. This is a vicious cycle with no clear end in sight.

Right now, the Preferential Law Initiative that seeks to prioritize the dispatch of thermal generation facilities over renewables is being voted at the Congress. Industry stakeholders expect its resolution will be accompanied by numerous lawsuits, unconstitutionalities, and even international controversies. The question is, how many power outages will take place until the national energy policy sets a clear pathway to follow?

[1] The highest PML of the Day-Ahead Market (MDA) was recorded in Laredo Americano (USA) at 1870.6 USD/MWh.

[2] Oneok Gas Transmission (OGT), an intrastate pipeline within the State of Oklahoma

[3] Several coal plants and one of Texas’ four nuclear facilities were also knocked offline by cold temperatures. In addition, wind farms froze.

[4] Global energy consumption, including power generation, transport, and industrial use.

[5] For instance, Guanajuato Government rejected the use of fueloil in Salamanca’s power facility, and a day later declared an environmental contingency

[6] The US holds three main energy grids: The Eastern Interconnection, the Western interconnection, and ERCOT.