Constitutional Reform Initiative: modelling curtailment for potential dispatch scenarios

CONTEXT

The Constitutional Reform Initiative presented by the Mexican president Andres Manuel Lopez Obrador to Congress on the 30th of September of 2021, may transform the landscape of the Mexican Electricity Sector.

After a series of regulatory actions taken by the Mexican government and the Electrical Industry Law Reform (see our past publication), the new Initiative Decree intends to re-establish control of the entire value chain of the Electricity Sector to the State [1].

If approved, the Initiative Decree would place CFE in a central role, consolidating the different subsidiaries in one entity and absorbing CENACE. CFE would be the exclusive supplier of electricity, and SENER would oversee regulation, dissolving the CRE [2]. As such, private players would have to sell their production through CFE while subject to the contractual terms outlined by the latter.

In terms of the changes directly affecting the market, the reform proposes:

- At least 54% of the generation must come from CFE

- Legacy and long-term auction (SLP) contracts with private participants will be revoked, which includes self-supply contracts (AUT) and PIE power plants.

- Private participants will conform a residual market after the generation of CFE (46% or less of the generation).

At this stage, it is still unclear how exactly the 54% will be implemented, leaving space for interpretation and a range of possible market rules. Moreover, it is possible that the current proposal will be modified before and if it is approved. As such, at DNV we modelled several sensitivities based on our Reference case (Base case) to cover the different options:

SCENARIOS

- Base case: This scenario considers the current wholesale market operation framework, where energy dispatch follows a marginal costs merit order. Based on Antuko 2021 Q3.2 modeling base, it serves as a reference of where we stand today.

- CFE case: the FULL capacity of CFE must produce at least 54% of the annual generation if technically feasible

- CFE – Coal case: the FULL capacity of CFE except for CFE coal plants must produce at least 54% of the annual generation if technically feasible

- PIE and SLP case: selected PIE power plants[3], as well as SLP units, can sign contracts with CFE, by-passing the Economic Dispatch and counting as CFE generation towards producing 54% of the annual generation.

- CFE Must Run case: the FULL capacity of CFE excluding CFE Coal plants, must always produce at their maximum capacity. This case explores the possibility that CFE might want to ensure all its power plants produce as much as possible and leave the residual market to private participants and coal plants. This is the most extreme scenario.

RESULTS

At Antuko/DNV we use PLEXOS, a Unit Commitment and Economic Dispatch optimization modelling software to predict the operation of the National Electrical System (SEN). This software simulates the operation of an electric system optimizing dispatch of the available generation to serve demand within a given set of constraints. By matching the transmission network, forecasted demand, installed capacity (particularly from CFE power plants), and a group of constraints that include the 54% threshold, PLEXOS optimizes the dispatch of power plants and power flows to minimize generation costs in the system. As a result, the model gives precise insights about the operation and curtailment of each power plant in every scenario.

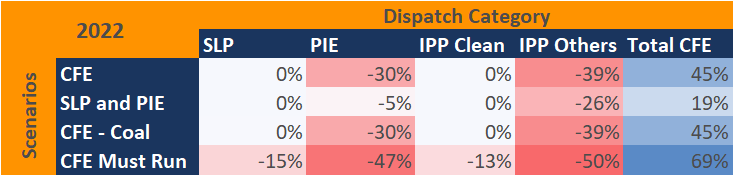

By comparing the four sensitivities VS the Base Case for the 2022 period, the relative differences in generation volumes are broken down by category: generators from Long-Term Auctions (SLP), Power Producers under the PIE contractual scheme (PIEs) [4], and Independent Power Producers (IPPs) where IPP Clean = Solar and Wind, IPP Others = Other technologies. All results presented below are system-level values, meaning that they are average values for the entire Mexican Electric System (SEN) and may differ significantly from region, unit or node-specific results.

Generation by Dispatch Category – SEN

Table 1: Relative System-Level Generation difference compared to the Base Case in 2022

- Clean Energy Sources (SLP and IPP Clean) are mostly unaffected in our different scenarios. Only in the most restrictive scenario (CFE Must-Run), their generation volume drops.

- Private Thermal plants (IPP Others) are the most affected, as their production is cut down between 25% and 50% compared to the Base case

- CFE is the big winner in all scenarios, increasing its production in a range from 19% to 69% compared to the base case.

- The CFE Must-Run scenario severely affects private players, reducing generation across all dispatch categories.

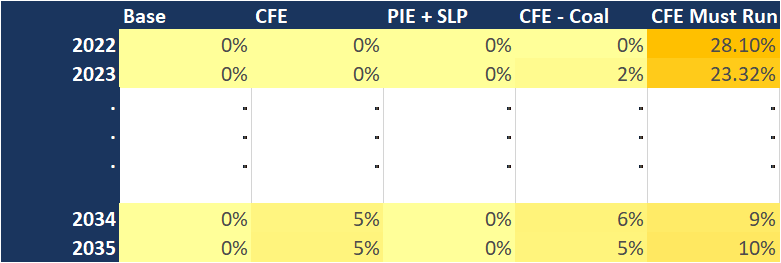

Solar Curtailment – SEN

Table 2. Yearly System Level Average Solar Curtailment per Scenario

- Solar power plants show low curtailment in most scenarios. However, the CFE Must-Run scenario shows high curtailment, demonstrating the potential consequences of forced dispatch of CFE units. All CFE scenarios show medium curtailment in the long-term.

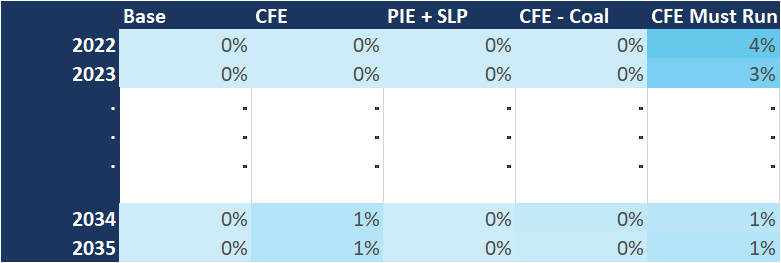

Wind Curtailment – SEN

Table 3. Yearly System-Level Average Wind Curtailment per Scenario

- Wind power plants show little to no curtailment both in the short-term and long-term for most scenarios (Wind assets are more likely to generate during the evenings and nights and compete less with solar assets). The CFE Must-Run scenario shows higher curtailment in the short-term.

The tables above show the impact of changing the dispatch order in the short and long-term for renewable power plants. It is important to understand that these results are system-wide, whereas curtailment is site-specific, varying from region to region, and even from node to node. Under the constraints explored in this article, curtailment for specific projects can change drastically according to the local CFE capacity, local demand, transmission constraints, etc. Moreover, detailed impact on PMLs is also available for the whole system as well as for specific nodes. Interested in a breakdown of regional or project-specific results?

Send us a message at: energy-markets-mx@dnv.com

[1]P. Mentado, « La contrareforma energética de AMLO, 25 puntos clave », 2 Oct 2021. [Online].

Available: https://factorenergetico.mx/2021/10/02/la-contrarreforma-energetica-de-amlo-25-puntos-clave/

[2]JD Supra, « Iniciativa de Reforma Constitucional para el Sector Energético », 5 Oct 2021. [Online].

Available: https://www.jdsupra.com/legalnews/iniciativa-de-reforma-constitucional-9814944/

[3] Antuko/DNV selected 14 power plants to have the highest change of continuing to supply energy to CFE. This selection was done based on their generation and capacity costs, as well as the remaining contractual term.

[4] PIEs are private power plants with a special generation permit that allows them to sell energy to CFE through CFE Intermediation Generator. This contractual scheme, together with the self-supply permit, was first introduced in 1975 by the Electric Public Service Law.