Duck curve in Chile: the need for flexibility solutions

The concept of duck curve is now quite well known in markets with large renewable penetration and refers to the shape of the net load in an electrical system with large amount of solar generation. Therefore, it is a concept that applies well to Chile, where solar PV accounts for 13% of the installed capacity (according to CNE data from October 2020) and 16% of the electrical generation (for the first ten months of 2020).

The evening ramp is increasing quickly in the Chilean system

This significant solar PV generation has had strong impacts on the Chilean electrical system for years: at first it caused congestions on the 220 kV transmission systems which led to a decoupled system during solar hours and marginal costs at USD 0/MWh. The situation has now improved thanks to the new 500 kV transmission system from Polpaico to the North, but as solar power plants keep being installed, the impact on the net demand curve becomes more and more significant.

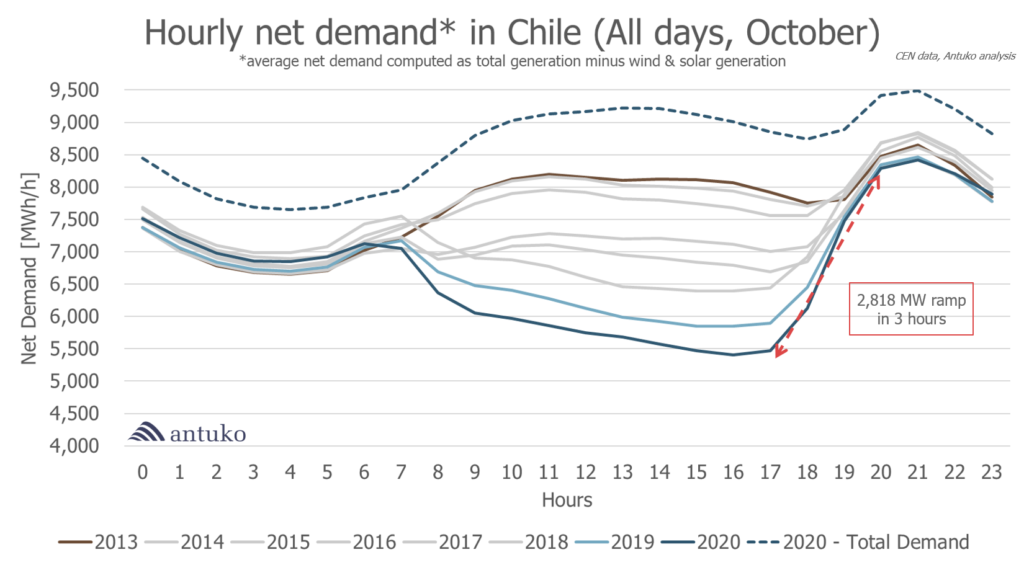

In average for the month of October 2020, the net load reached its minimum at 4 pm, slightly below 5,500 MWh/h. Although the Covid19 pandemic is still a reality, the electrical demand has increased from last year and so this low net load is not the sign of a depressed demand. Besides, solar and wind curtailment were respectively 27.8 GWh and 15.8 GWh for this month, which means that demand load could have been even lower. Consequently, the electric system had to face ramp of 2,818 MW in 3 hours in average in 2020 (939 MW/h), to be compared to 2,453 MW in 3 hours in October 2019 (818 MW/h): this a 15% increase in one year.

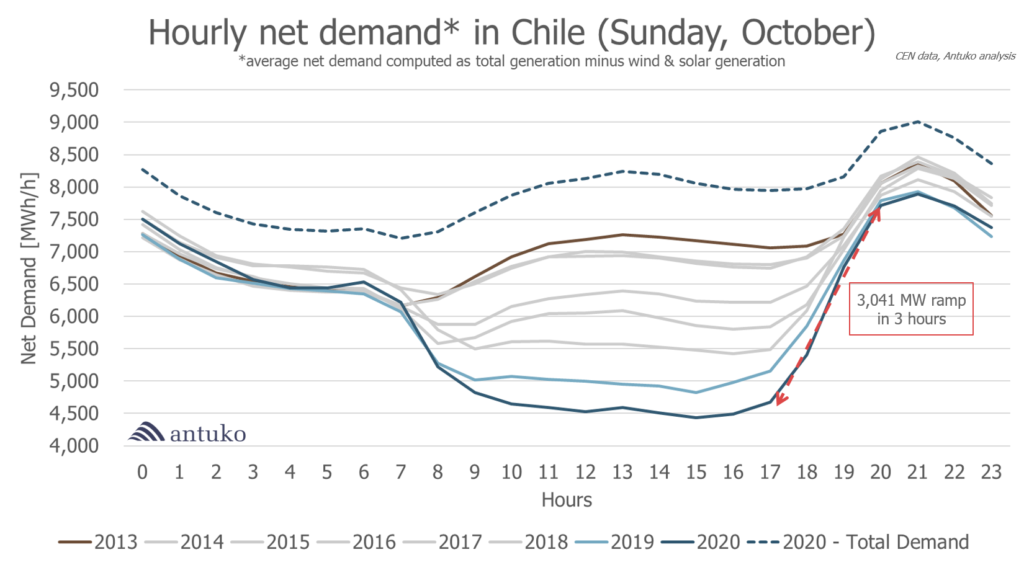

The need for flexibility was even higher on Sunday, as demand is lower during this day, in particular during the solar hours (for this time of the year): whereas in October 2019, ramps on Sunday were on average 2,631 MW in 3 hours (877 MW/h), they increased to 3,041 MW in 3 hours in October 2020 (1,014 MW/h). In average, the net demand reached 4,500 MW, which led to prices at USD 0/MWh almost every Sunday of October. This is due, among other factors, to the minimal load constraints of coal power plants, which stay switch on to provide ancillary services and to supply the evening ramp and the evening demand.

The importance of a clear regulatory framework to face flexibility needs

Today, conventional technologies are still the ones which answer these flexibility needs in the system: first coal power plants, then LNG and finally dam power plants. As we mentioned, it has consequences on prices due to the inflexibilities associated to these power plants. With more coal power plants expected to close in the coming years (officially for now, the last unit must close at last in 2040), there would be more room for solar generation during solar hours but also less cheap energy[1] during the evening.

Which technologies would replace it? Although open cycle gas turbines may provide the needed flexibility during some time, they are obviously too contaminant in the long run and should only be used as a transition. The high marginal cost set by fast response gas turbines should help developing more durable solutions such as energy efficiency, demand response and battery storage, but a clear regulatory environment, on which the government is already working, is also needed to reach a decarbonized electrical system. Its robustness and stability are key for developers, investors, and suppliers to implement new ways of managing energy. There are especially high expectations regarding the new regulatory rules for capacity recognition and for the new trading figure in the market.

[1] CO2 tax is still low in Chile and not included in the power plant variable cost to determine the merit order and the marginal cost at which all transactions are made.