LIE Reform: What does curtailment look like under the new dispatch criteria?

In past weeks, the power industry has been at the center of the national agenda. This started on February 1st, with the submission of a Preferential Law Initiative aiming to change several dispositions of the Electricity Industry Law (LIE) framework (Read more about this issue in our previous blog entry!).

After a month full of discussions between the House of Representatives and the Senate, this document was finally approved and published on the Federal Official Gazette (DOF) on March 9th. However, two days later, the Second District Court in Administrative Matters granted a temporary injunction with general effects, meaning its scope applies to any particulars that operate under regulated activities within the sector. This was followed by a permanent injunction, as well as many more amparos1 from market participants, and even international NGOs like Greenpeace!

While these trials are set to continue in the following months, the Antuko team conducted a quantitative analysis to better understand the potential change in dispatched volumes under this reformed framework. Curious about the outcome? Keep reading!

According to the LIE Reform, energy dispatch would follow these criteria, instead of the business-as-usual economic merit:

⚡️ First, hydropower plants (where CFE owns most of these assets),

This considers the Grijalva Agreement restrictions, where volumes will be determined by a Hydraulic Operations Technical Committee.

⚡️ Second, CFE power plants,

This includes energy generation coming from nuclear, geothermal, CCGTs, and thermoelectrical assets

⚡️ Third, wind and solar private players,

Solar and wind private players with LIE PPAs fall under this category. Since the bill also proposes that every Self-supply contract will be revoked, renewable projects with contracts prior to the 2014 Energy Reform will most likely fall into this category as well.

⚡️ And finally, fossil-fueled power plants from private players.

Thermal players with LIE PPAs fall under this category. Since the bill also proposes that every Self-supply contract will be revoked, fossil-fueled projects with contracts prior to the 2014 Energy Reform will most likely fall into this category as well.

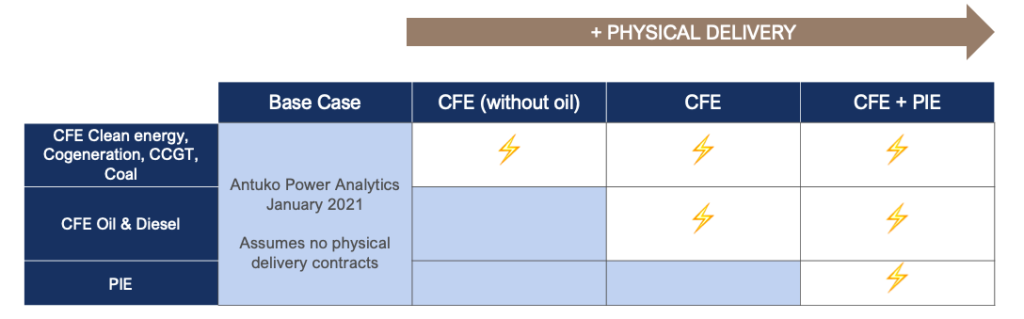

These documents establish that the new dispatch model relies on a new type of contract called physical delivery contract (= physical PPA), which allows a power plant to be dispatched by-passing the economic merit of order. This kind of structure is already operational and popular in several European markets and in Latin-American markets such as Colombia.

In order to study the potential impact this new dispatch could have, Antuko modeled the Mexican system using the aforementioned criteria. Unfortunately, both the Preferential Law Initiative and its final publication in the DOF are not clear about the role of certain assets under this new dispatch model, eg. Legacy Independent Power Producers2, which leaves some room for interpretation.

As such, we developed three sensitivities to address different operational scenarios, being the most relevant the following:

➡️ Base Case: This scenario considers the current wholesale market operation framework, where energy dispatch follows an economic merit. Based on Antuko January 2021 modeling base, it serves as a reference of where we stand today.

➡️ CFE (without oil): This scenario is based on a document that resulted from a MORENA Q&A session at the Chamber of Deputies, where it is stated that “only conventional thermal power plants that use natural gas will be included in these contracts (physical delivery)”. Hence, CFE power plants that use fuel oil or diesel as their primary fuel are not included in this scenario.

➡️ CFE: This scenario considers full CFE capacity, meaning all the utility’s assets will have physical delivery contracts to be dispatched with priority. CFE power plants using HFO and diesel could benefit from PEMEX fuel oil production.

➡️ CFE + PIEs: This scenario sets its basis on the latter, but also considers that some PIE contract holders will renegotiate their PPAs to operate under the physical delivery model.

To gain a realistic approach on these potential developments, Antuko thoroughly studied important aspects such as the installed capacity evolution in the short-term, the role of PIEs within the system and the likelihood of their migration to physical PPAs, the overall participation of CFE assets including their maximum capacity factors, and planned maintenance. This study considers the following market assumptions:

⚡️ Installed Capacity: Future Additions & Decommissioning

This analysis takes as a starting point the 2020-2034 PRODESEN, the 2021-2025 CFE Business Plan, and Antuko January Base Case Works Plan.

- In this line, the PRODESEN 2020-2034 proposes 13.7 GW of additional capacity by 2024, where 4.5 GW are from CFE, and 9.2 GW from private generators.

- The Antuko Works Plan is more conservative, as it expects CFE to install only 2.4 GW by 2024, and delays the rest of the utility’s projects toward 2028.

- On the private generation side, the current regulatory context could complicate the installation of new private projects. Antuko only considers 5.6 GW of feasible and confirmed projects between now and 2024.

⚡️ Role of PIEs:

- To date, there are 34 power plants under the PIE contractual scheme, representing a total capacity of 16.6 GW (16 GW of CCGTs and 0.6 GW of wind).

- Antuko conducted an extensive review of each of these assets, and based on official data[1], selected 14 power plants that have the highest chance to continue supplying energy to CFE. This selection was made based on their generation and capacity costs, as well as the remaining contractual term. The rest of the PIEs are thought to be forced to migrate lo LIE, as are all of the AUT projects.

⚡️ Participation of CFE Assets:

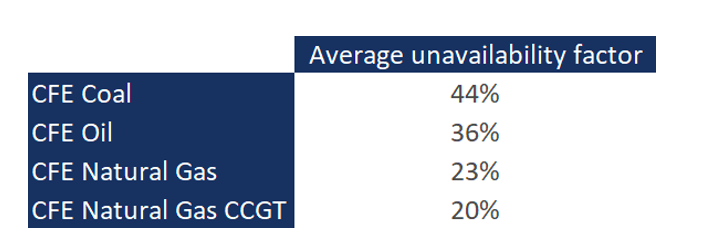

- To date, CFE represents about 50% of the overall installed capacity in the country. Given the new dispatch model prioritizes its participation, Antuko executed an extensive review of each of CFE’s power plants to assess their unavailability.

- Based on previous editions of the Capacity Balance Market, Antuko identified the Availability of Physical Production for each CFE power plant, and determined an Unavailability Factor for coal, HFO and diesel power plants.

- This Unavailability Factor represents planned maintenances, as well as unexpected failures these power plants might suffer.

RESULTS

Antuko uses PLEXOS, a Unit Commitment and Economic Dispatch optimization modelling software to predict the operation of the National Electrical System (SEN). This software simulates the operation of an electric system to try and optimize dispatch of the available generation to serve demand within a given set of constraints. By matching the transmission system capacity, regional demand, and the installed capacity (particularly from CFE power plants), it is possible to identify bottlenecks and zones where curtailment will be most likely to take place.

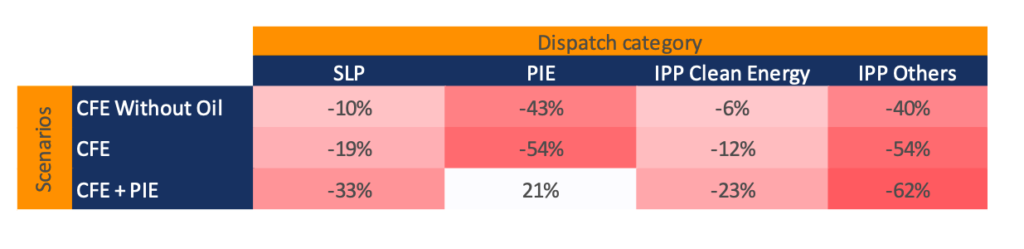

By comparing the three sensitivities VS the Base Case for the 2022 period, the differences in generation volumes are the following:

- All private dispatch categories will be negatively impacted unless explicitly prioritized in dispatch. PIE is the only category with a higher generation volume in such cases.

- In the most restrictive case (CFE + PIE), private wind and solar power plants (SLP and IPP Clean Energy categories) will suffer moderate curtailment in the short term.

- Private thermal power plants are the most affected ones by the new dispatch model, as their production is cut by more than half depending on the scenario.

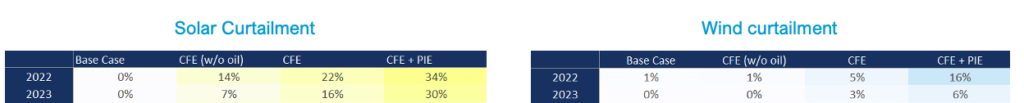

In terms of renewable curtailment (solar and wind), the short-term results are the following:

| ☀️ Solar power plants suffer a relatively high curtailment at the beginning of the modeling scenario. | 💨 Wind power plants are also affected in the first years of the study, but to a smaller extent. (As these assets are more likely to generate during the evenings and nights). |

| ☀️ In the worst-case scenario (CFE + PIE), curtailment starts at 34% in 2022, and progressively decreases as demand rises. | 💨 Curtailment progressively decreases as demand rises. |

The previous table shows the impact of changing the dispatch order in the short-term run. However, the Antuko team modeled these scenarios up to 2035! In addition to this, since these are system-wide results, meaning the chances of experiencing more or less curtailment vary from region to region, and even from node to node.

If you are interested in a breakdown of regional or project-specific results, send us a message at: mexico@antuko.com

[1] As of March 31st, 2021, the LIE Reform Initiative has summed up to 102 permanent injunctions

[2] Independent Power Producers, also known as PIEs, are private power plants with a special generation permit that allows them to sell energy to CFE through CFE Intermediation Generator. This contractual scheme, together with the Self-supply permit, was first introduced in 1975 by the Electric Public Service Law.

[3] Selection based on the following CRE document: “Términos, plazos, criterios, bases y metodologías de los Contratos Legados para el Suministro Básico y mecanismos para su evaluación”