Negative prices in Iberia: Who cares?

On Tuesday December 1st, 2020, OMIE president, Carmen Becerril, announced that the current price limits for Iberian Daily Market (EUR 0/MWh to EUR 180/MWh) were going to be modified in order to follow the same limits as other European markets: EUR -500/MWh to EUR +3000/MWh.

Will this have a relevant effect on daily operation and hourly prices in Spain?

Are we already reaching the limits?

The first question to ask would be: are we already reaching any of the current limits? The upper limit of EUR 180/MWh has never been reached during the last 10 years. What about the lower limit of EUR 0/MWh?

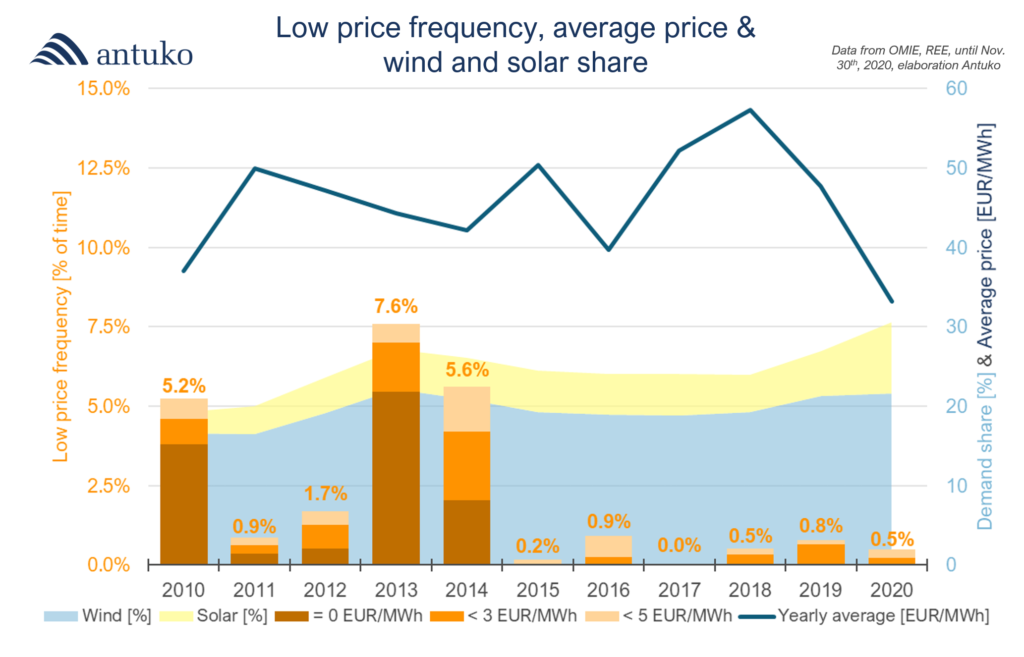

In the next figure, we show:

- The percentage of total time during which market prices in Spain were:

- Equal to EUR 0/MWh

- Below EUR 3/MWh

- Below EUR 5/MWh

- The share of electricity demand that was supplied with wind + solar generation

- The annual average price of the Daily Market.

Our observations:

- 2013 was the worst year in term of low prices:

- It remained below EUR 5/MWh 7,6% of the time

- It reached EUR 0/MWh 5,5% of the time

- No relevant zero price occurrence happened since 2014!

- Since 2014, prices below EUR 5/MWh only happen 0,9% of the time, and no prices at zero were observed!

- The low-prices frequency seems to be independent from average Daily Market price.

- Wind and solar share in the system grew during the last decade, with no identifiable impact on low price frequency since 2015.

- In 2020, despite covid-19 health crisis and its impact on market (price drop and wind and solar share increase), the low-prices frequency remained as low as previous years.

What have changed since 2015?

In 2014 wind and solar plants started to participate in the day-ahead bidding market (which was not the case before because they had a feed-in tariff regime). At first, they were a bit clumsy in the way they input their bids on the market, but they quickly learned that they could not send their orders in big and cheap chunks, otherwise prices would collapse, and this would hurt all the market players. So they started to sophisticate their order-input techniques, as well as the way they handle their other production assets (in case of large IPPs and utilities). And they learned quickly, preventing price from dropping too dramatically.

As we published last year (see here), thanks to their sophisticated bidding techniques, wind players improved their captured price, and solar plants started to bid as aggressively any other electricity producer.

Last week, Shell Trading was the market trending topic because it managed to set the day-ahead price at 10 p.m. in July 2020 with offers made on behalf of a tiny solar plant.

All these facts prove that market participants are sophisticated players, that know how to place bids in a way that does not harm their interests, in other words that know how to prevent prices from reaching unsustainable levels.

With all that in mind, the theoretical possibility of negative prices in Spain does not seem very scary…