Spain: is renewable cannibalization unavoidable?

Electricity spot market has always been highly volatile, usually depending on fossil fuels prices and hydro availability. Nowadays, electricity spot price strongly depends on wind and solar. What to expect for the future?

This analysis has been presented for the first time to the Spanish Photovoltaic Union (UNEF), on February 19th 2020, in Madrid.

Why is there so much fear around renewable cannibalization?

Renewable cannibalization is announced by many consultants. It is a nightmare for IPPs, developers, banks and investors.Looking at European electricity spot market, we see negative prices more frequently each year, when wind blows strong in Germany during weekend, or on some sunny Sundays.Going overseas, Chilean and Mexican electricity markets are often used as references about large wind and solar penetration, due to their exceptional resource, and the boom experienced during past years in the renewable part. This important disruption led to strong price drops and curtailment.Will this happen in Spain? First, let’s have a look to what happened overseas.

Chilean experience: price drops, area decoupling, curtailments

To understand what happened in Chile, here are some must know market basics:

- Chile has a liberalized market since the 80’s, with open access for connection to transmission grid, which may lead to some energy excess. The market is called SEN, for National Electric System (Sistema Eléctrico Nacional).

- Market price is controlled by the TSO: the offered price by each technology is defined by the TSO. Renewable sources (wind, solar, run-of-river hydro) have USD 0/MWh marginal cost, thermal generation marginal cost is calculated depending on audited technical information and fuel costs, and dam marginal cost is calculated by the TSO. Dam operation is also fully controlled by the TSO.

- It is a nodal market: each node has its own price, result of the local offer/demand balance and its connexion capacity with the rest of the system. Without congestions nodal price difference is only due to electrical losses. With congestions, areas are separated, each one with its own price.

- Transmission grid is still critical: due to Chilean geography, there is only one main North-South transmission line. Some sections still need important reinforcements, and there is almost no connexion with neighbouring countries.

Now that the Chilean scene is presented, how strong was the wind and solar disruption?

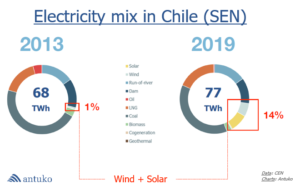

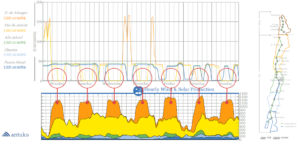

Within six years, wind and solar went from representing 1% of the energy mix to 14%, while demand grew more than 2%/year.This wind and solar disruption allowed to break free from the need of oil generation, and to balance the reducing hydro generation.Also, this led to extremely strong price drops and decoupling each time the sun was rising in the North of the country. The next figure shows a week of November 2017. Each price area and wind and solar generation is coloured by zone, following the map on the right.

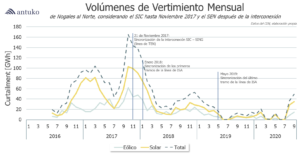

Every day, price was locally dropping to USD 0/MWh, reducing dramatically all the merchant revenues of wind and solar projects. Only few of solar plants were able to capture some value during the first and last hour of non-zero marginal cost, thanks to their trackers.And this price meltdown did not come alone: each time price was crashing to zero, there was a local excess of renewable energy, which had to be curtailed. Next figure shows monthly average curtailment of wind and solar, as we published in November 21st, 2019. (EDIT: this image has been updated with the data published on October 26th)

As said before: transmission grid was not prepared to receive this wind and solar disruption. Nevertheless, step by step, the grid has been improved, slowly reducing the curtailment rates. Now, the low remaining curtailment is mostly due to local congestions, in specific areas, and does not impact prices as before.

[…] we entered in the “duck curve price era”, for now and ever […]

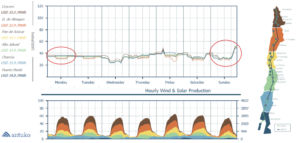

The next figure shows spot prices and wind and solar generation in January 2020, as published in our Wind and Solar Weekly Report.

Now there are much less price congestions and decoupling. Nevertheless, it is worth noticing that we entered in the “duck curve price era”, for now and ever: with large amount of solar generation, price will always be lower during day hours than during night.

Mexican experience: following the path of Chile

In Mexico, market rules and structure are similar:

- Mexico has a liberalized market since 2016, with open access for connection to transmission grid, which may lead to some energy excess.

- Market price is “suggested” by the TSO: it is theoretically possible to bid for generation or demand, but this possibility is not used, and the marginal cost of each technology follows the same definition as in Chile.

- It is a nodal market.

- Transmission grid is still critical, and operation is not as transparent as in Chile.

- Renewables are growing fast, mostly in remote areas with good resource (such as Sonora desert).

The next figure shows, as for Chilean experience, one week of hourly spot price for one main node of each area of Mexico. This information is extracted from our Mexican Weekly Report of February 14th, 2020.

As for Chile, Northern Mexico is seeing strong price drops and area decoupling every day. This is getting worse, as wind and solar plants keep entering in the market, faster than grid reinforcements take place.

And now in Europe? Spanish case

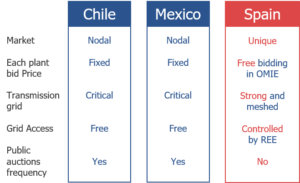

In Spain, the market rules, the grid and the public support of renewable penetration are different than in Chile or Mexico. These differences are summarized in the following table:

These differences are fundamental to make the integration of renewable energy in the electricity market operation easier.

The path of wind captured price

At first, Spanish wind plants were receiving their revenue out of the OMIE Daily Market (electricity day ahead market). But in 2013 they started to receive payments for their Daily Market energy.When they entered in the Daily Market, they had a strong impact on prices: each time wind was blowing strong in Spain, the price was dropping. The average wind captured price was 85% and 87% of the arithmetic average of Daily Market price in 2014 and 2016, as shown on the next figure (published for the first time in December 2019). People started thinking it would keep decreasing as wind installed capacity would grow in Spain.

But then, Spanish wind operators started to understand better how to use the market possibilities and how to bid their energy. They were able to maximize their revenue, and now, the price does not drop as dramatically as before when wind blows strong in Spain.The best example is March 2018: it was the month with the highest wind generation ever in Spain. Nevertheless, wind captures price only dropped to 96% of Daily Market arithmetic average.Spanish wind plants showed the right path: renewable generation is a market player as any other.

Solar is following wind path

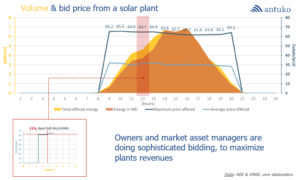

Why would solar plants not do the same? They do.The next figure shows an example of a solar plant bidding strategy, from one day in May 2018.

During that day, this solar plant offered at an average price close to EUR 30/MWh, with a maximal bid price varying around EUR 63/MWh. On that day, SPOT price varied around EUR 63/MWh. Then, this solar plant did not match all its generation in OMIE Daily Market.

[…] solar generation can also be a market player as any other […]

Looking at the hour 12: SPOT price (EUR 64.6/MWh) was just below its maximal bid (EUR 64.7/MWh). Then its last MWh stayed out of Daily Market. This does not mean energy was lost: it has been used in other markets, as intraday markets (which price can be higher or lower than Daily Market).This example shows that solar generation can also be a market player as any other. Until now it was not necessary, due to feed-in tariff and low market share, but this will change in the future.

Renewable cannibalization is avoidable: market is the key

This decade, wind and solar generation will strongly increase in Spain, but also in the whole Europe. Many market players fear cannibalization as we saw in Chile or Mexico, but this will not happen that way.As renewables can bid, as any other market player, they can optimize their market participation: indeed, sometimes it may be better to stay out of Daily Market for a few percent than create a strong drop price. And this is possible.By optimizing their market participation using sophisticated energy bids, owner and market asset managers can contain the price drops due to renewable generation. It is obvious that market price will be lower and more volatile with high share of wind and solar, but it does not have to drop to unsustainable values.With the right rules, the cannibalization of renewable energy in electricity market can remain as a myth in sophisticated markets.