Mexico | COVID-19 Impact on PMLs

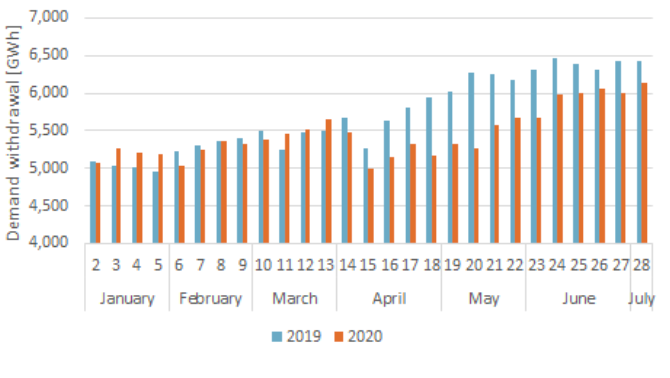

The COVID-19 sanitary crisis has disrupted every industry worldwide, and the energy sector is no exception. Only in the first half of 2020, electricity demand fell around 10% VS 2019 levels:

Weekly Demand Withdrawal at the MDA (2019 VS 2020)

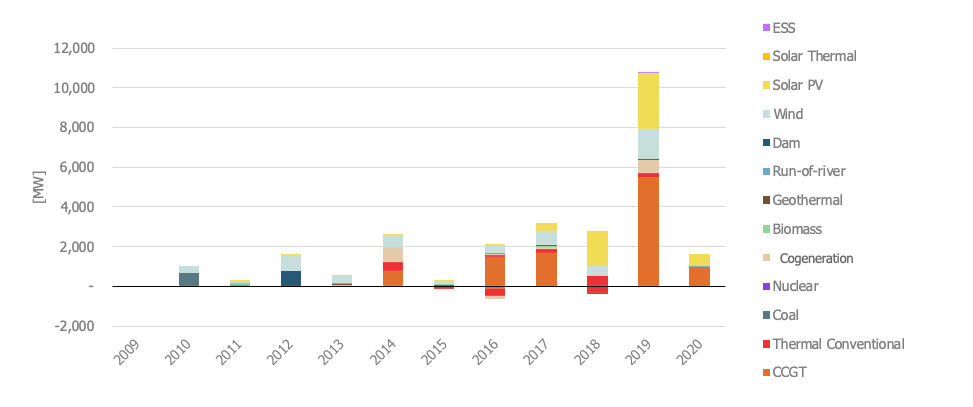

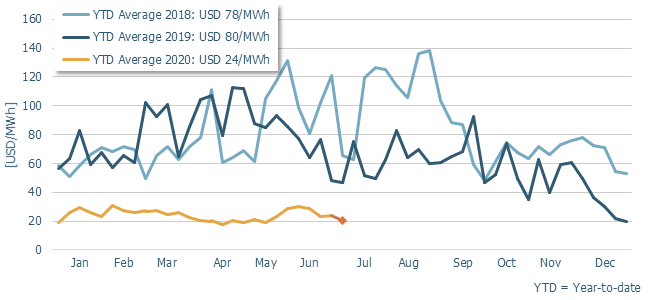

However, what does this impact mean in terms of pricing? The following graph shows the evolution of the PML in the past three years. While in the first half of 2010 prices were relatively high (between 40-120 USD/MWh), this drastically changed on the second half of 2019 due to a large renewable penetration motivated mostly, by the long-term electricity auction mechanism.

Historical Installed Capacity and Decommissioning per Technology

As such, PMLs started to fall in the Summer and finally stabilized around 20USD/MWh by the end of December.

Energy Component of the National Interconnected System – Weekly average

Under normal conditions prices would have tended to increase, even with the additional capacity, as we approach the Summer due to warmer temperatures. However, PMLs have not yet recovered mainly because of:

- COVID-19 Lockdown: Lower economic activity = Lower energy demand

- Fuel Price Shock: Falling fuel prices = Lower marginal costs

There are still 12.2GW of projects in the pipeline that are set to come online between 2020-21 even considering the current regulatory landscape and the disruption to the industry’s global supply chain. These additions might experience some delays but they will mostly come online. On the side of fuels, prices will remain low until demand bounces back.

The most recent Antuko models forecast that electrical demand will not reach 2019 levels until 2022 and PMLs will remain in the 20- 40 USD / MWh range.

Curious about the PML evolution on the following weeks? Do not forget to subscribe to our Mexico Antuko Weekly Report here!